If you are married and a California resident, and you own a home, you will need a joint revocable living trust as the primary document in your California estate plan.

Since you are a California resident, most, if not all of your assets will be community property. Community property means that half of the assets are yours and half are your spouse's.

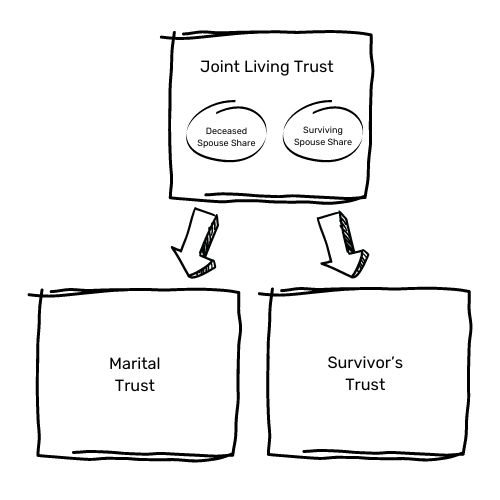

When you design your living trust, you need to decide how each of you want your share to be distributed when the first of you pass away.

Most of our clients choose from two options:

Option 1. Allocate your share to the Survivor’s Trust.

While you are both alive, your probate assets (real estate, investment accounts and large bank accounts) should be owned by your joint living trust so your family will not have to go through the costs and hassles of California probate.

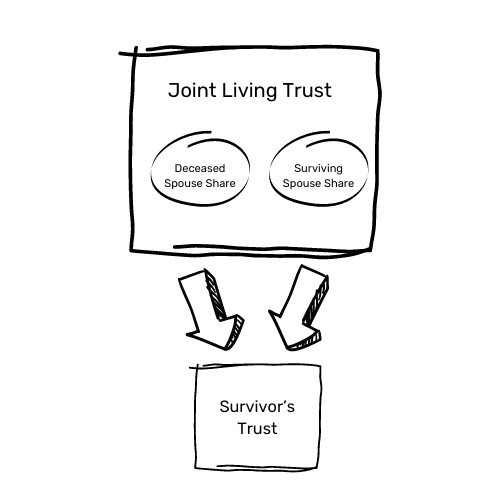

Most California joint living trusts are written so that at the first death, the surviving spouse's share and the deceased spouse's share will go to the “survivor’s trust.”

The survivor’s trust is a sub-trust created out of the joint living trust at the first death.

A typical survivor’s trust has the following terms:

- Surviving spouse is the sole trustee.

- Surviving spouse is the sole lifetime beneficiary.

- The survivor’s trust is revocable. The surviving spouse can amend or change the trust terms, including changing the remainder beneficiaries.

Option 2. Allocate your share to a Marital Trust.

Like the survivor’s trust, a marital trust is a sub-trust created out of the joint living trust when at the first death. The marital trust can hold the deceased spouse’s separate property and his share of the community property.

A typical marital trust has the following terms:

- Surviving spouse is the trustee.

- Surviving spouse is the primary or only lifetime beneficiary.

- The marital trust is irrevocable. The surviving spouse cannot change the remainder beneficiaries.

Two Types of Marital Trusts

There are two types of marital trusts, a “bypass trust” and a “QTIP trust.” Both are irrevocable trusts, but each has different uses and tax consequences.

Bypass Trust

Generally, a bypass trust is used for a family with a high net worth estate.

At the first death, assets allocated to the bypass trust will use some or all of the deceased spouse’s estate tax exemption. As a result, any future appreciation and growth in the bypass trust assets will escape the estate tax.

The downside to a bypass trust is that when the surviving spouse dies, the assets in the bypass trust will not receive a step-up tax basis. For more info on capital gains, step-up tax basis and bypass trusts, click here.

QTIP Trust

A QTIP trust (no, it's not named after the cotton swab, but after a definition in the Internal Revenue Code - qualified terminable interest property trust) is often used for a blended family where one or both spouses have children from a prior relationship.

Like the bypass trust, a QTIP trust separates the deceased spouse’s share of the trust assets to secure the remainder beneficiaries so the surviving spouse can’t change the beneficiaries.

However, unlike the bypass trust, the QTIP assets will be included in the surviving spouse’s estate for estate tax purposes, and, consequently, the assets in the QTIP trust will receive a step-up tax basis.

Disclaimer Trust Provisions

Most of our married clients use a living trust with “disclaimer trust” provisions. With the disclaimer trust provisions, by default, when the first spouse dies, his share of the trust assets will be allocated to the survivor’s trust. This is Option 1 above.

However, the disclaimer trust provisions allow the surviving spouse to allocate some or all of the deceased spouse’s share to a bypass trust. If, at the time the first spouse dies, the asset mix, family situation or tax laws are such that it would be beneficial to use a bypass trust, the surviving spouse can “disclaim” some or all of the deceased spouse’s share of the trust assets. Any disclaimed assets will be allocated to the bypass trust.

A living trust with disclaimer provisions gives the surviving spouse a lot of flexibility to make a game time decision about whether or not she needs a bypass trust.

Most of our married couple clients use a living trust with disclaimer trust provisions.

Disclaimer trust provisions are ideal for couples in their first marriage, where their children are all joint children, and where all or most of their assets are community property.

High Net Worth Clients

For our high net worth clients, we often recommend a living trust with bypass trust provisions to protect the large and growing estate from the estate tax.

Blended Families

One of the estate planning challenges for a blended family is to make sure the children from both spouses receive an inheritance, not just the children of the surviving spouse.

For our blended families and second marriage clients, we often recommend a living trust with QTIP trust provisions to lock-in the deceased spouse’s remainder beneficiaries.

Conclusion

Designing your living trust estate plan is not as simple as Legal Zoom and other DIY websites may say it is, but it doesn’t have to be complicated if you work with a law firm that nows how to help you.